Fabrick's Open Finance platform

Models based on open platforms represent the new value chains, capable of promoting collaboration between cross-industry players and the crossing of financial and non-financial data, to enable the development of new use cases and business models. Thus, in 2018, we created the Fabrick platform, which combines Open Banking and Open Payments services to build new value to be integrated into the customer experience.

The primary business model fostered by this convergence is that of Embedded Finance, which identifies how financial services will be used in the future, which will be further integrated within experiences with other products and services, both in the B2B and B2C segments.

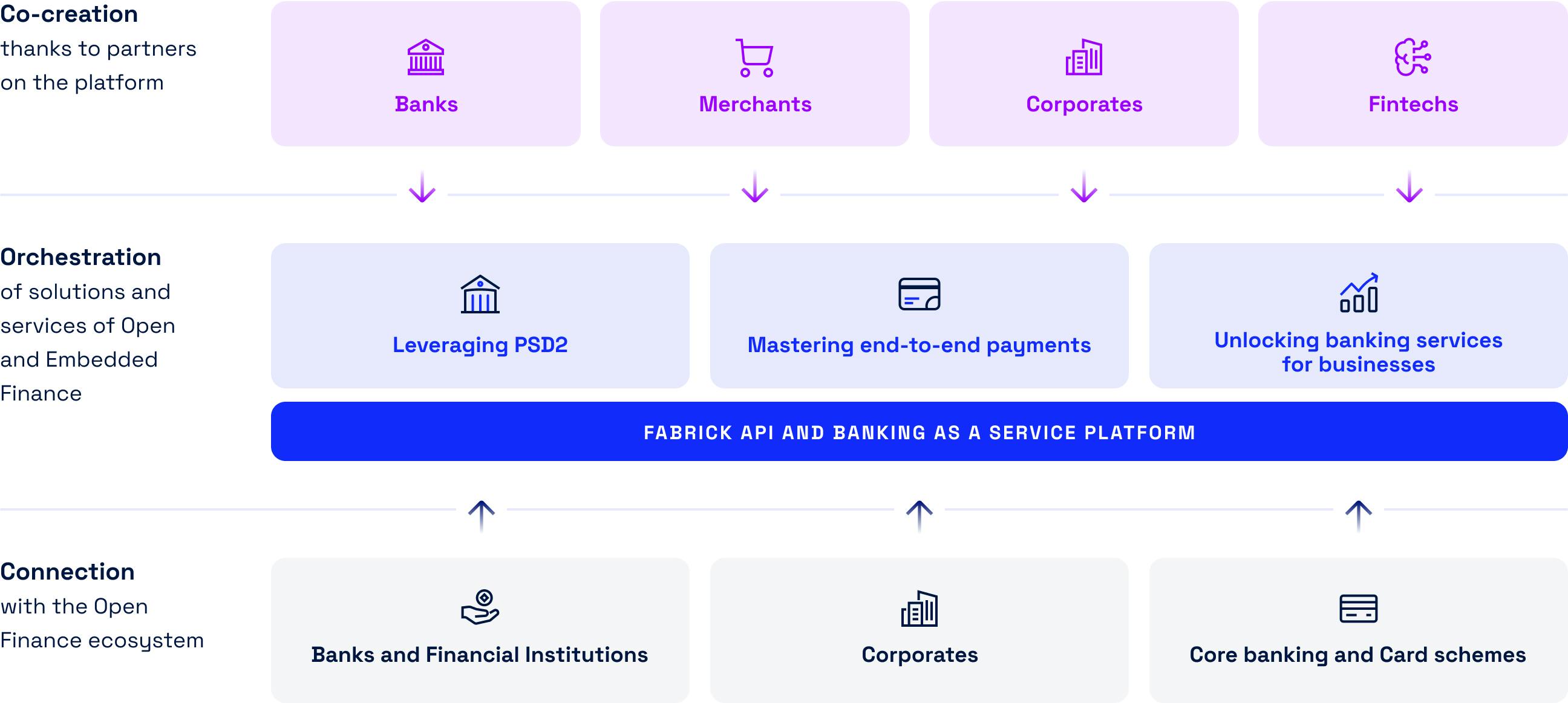

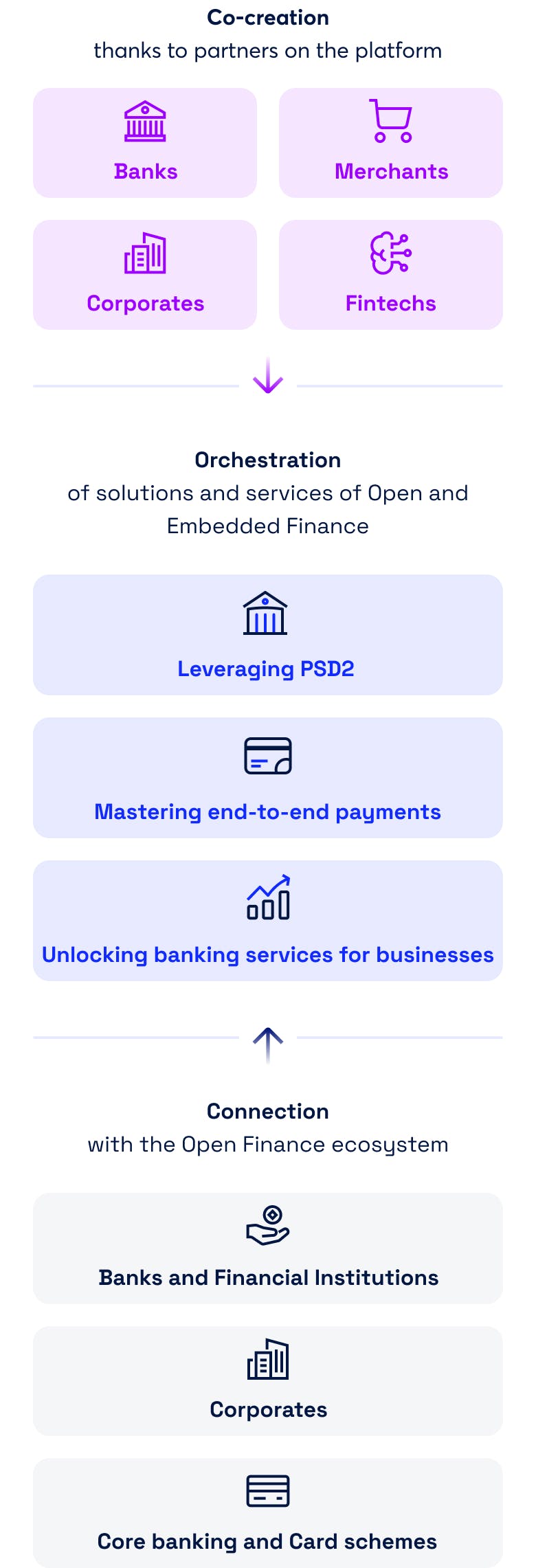

Our Open Finance platform contributes to taking part in this revolution thanks to:

700+ banks connected via PSD2 Gateway

Enable connections with the Open Finance ecosystem.

- 20+ use cases

- 250+ payment methods

- 1,400+ available APIs

- 295M+ API Calls each month

Natively orchestrating Open Banking and Open Payment services to enable the development of new use cases and new business models through APIs and standardization processes

400+ clients and B2B partners

Allowing to co-create advanced experiences with financial services in a «plug and play» mode.

How the platform works

The benefits of our platform

It allows for a fast integration of new solutions into an existing business model, leveraging third-party services, reducing development costs and improving time to market when launching new business initiatives.

Any company can start offering financial services benefiting from accessing the Fabrick infrastructure and license in an ‘as a service’ mode.

The possibility of leveraging data according to a platform logic improves customer knowledge and offers opportunities for customisation.

The availability of bank data and the possibility of leveraging APIs to access third-party databases make it possible to develop new ways of verifying customers’ identities and improve compliance and fraud management operations.

Our products

Access transactional data and enable companies to create value-added services.

The solution for account-to-account (A2A) payments to improve security, reconciliation and speed of execution.

Secure payments with post-authorisation fraud checks and chargeback guarantee.