Fabrick Payment Orchestra

Accept local and international payments and process them with the best gateways and acquirers. All in one platform.

The platform to boost conversions

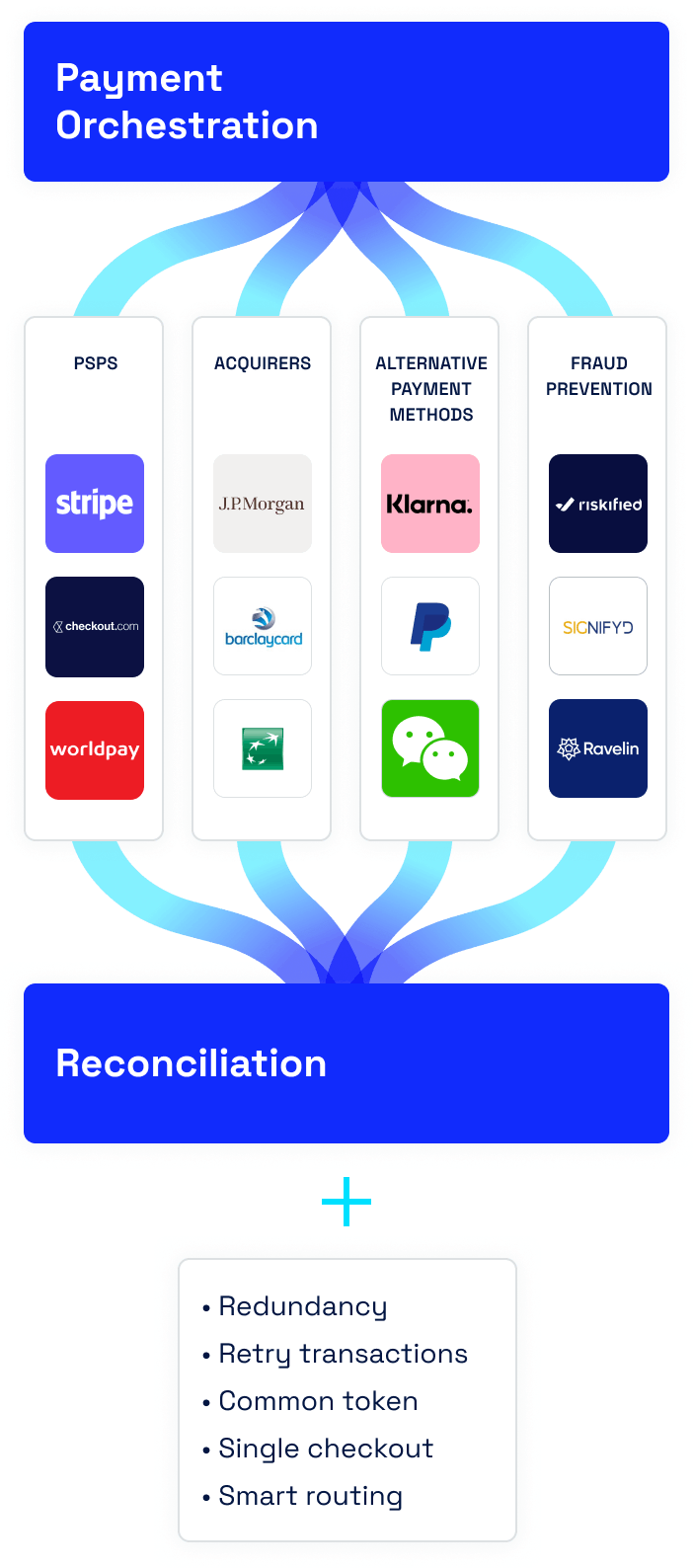

Fabrick Payment Orchestra handles all stages of payment processing, using smart routing technology to process each transaction with the most efficient provider and not to miss a single sale.

Accept local and international payments

Fabrick Payment Orchestra unlocks the business of any customer by providing all the payment options preferred by businesses and consumers:

- Payment acceptance in domestic and foreign countries

- Multichannel customer journey

- Over 200 traditional and alternative payment methods available

Accept local and international payments

Fabrick Payment Orchestra unlocks the business of any customer by providing all the payment options preferred by businesses and consumers:

- Payment acceptance in domestic and foreign countries

- Multichannel customer journey

- Over 200 traditional and alternative payment methods available

Process payments with cutting-edge tehcnologies

Fabrick Payment Orchestra enables the integration of multiple gateways and acquirers allowing the most efficient and convenient provider to be chosen for each payment:

- Smart routing technology to process payments in the most efficient way

- Local and international gateways and acquirers

- Automated processes

Process payments with cutting-edge tehcnologies

Fabrick Payment Orchestra enables the integration of multiple gateways and acquirers allowing the most efficient and convenient provider to be chosen for each payment:

- Smart routing technology to process payments in the most efficient way

- Local and international gateways and acquirers

- Automated processes

Automatic reconciliation

With Fabrick Payment Orchestra, payment management is simplified thanks to the centralisation of all collection steps in a single platform:

- Simple and automated reconciliation

- Single dashboard to monitor cash flows

- Integrated reporting

Automatic reconciliation

With Fabrick Payment Orchestra, payment management is simplified thanks to the centralisation of all collection steps in a single platform:

- Simple and automated reconciliation

- Single dashboard to monitor cash flows

- Integrated reporting

Growing your business has never been easier

Fabrick Payment Orchestra optimises payment management with the aim of growing business without generating complexity, only new opportunities.

The multi-gateway and multi-aquirer orchestration layer processes each transaction with the best performing provider and allows for a backup provider at all times so as not to miss a single sale.

The integration of both local and international payment methods also opens the door to foreign audiences, speeding up business expansion and reducing time to market.

Smart routing combined with machine learning makes payment processing more efficient and cost-effective, optimising resources and time.

Through advanced fraud prevention solutions, the platform reduces the friction of double authentication and ensures high levels of security, relieving the merchant of responsibility for undetected fraud.

Payment management via a single Dashbord to monitor revenue trends from each channel allows for advanced analysis, also thanks to integrated reporting.

Online, offline, digital: accepting payments from an multichannel perspective is the key to designing a seamless purchasing process and offering the customer the best possible experience.

Would you like more details about this product? Please fill out the form.

Contact our specialists to identify the most suitable solution for your needs.