Fabrick Financial Split Payments

The solution designed to simplify incoming payment collection and automate fund splitting among all parties involved in the sale.

Fabrick Financial Split Payments is not available in the UK. Fabrick provides this solution in Italy. If your business has a registered office in Italy and you would like information, please contact us here.

Direct, automated payouts

Boosting incoming and outgoing payments management in three simple steps:

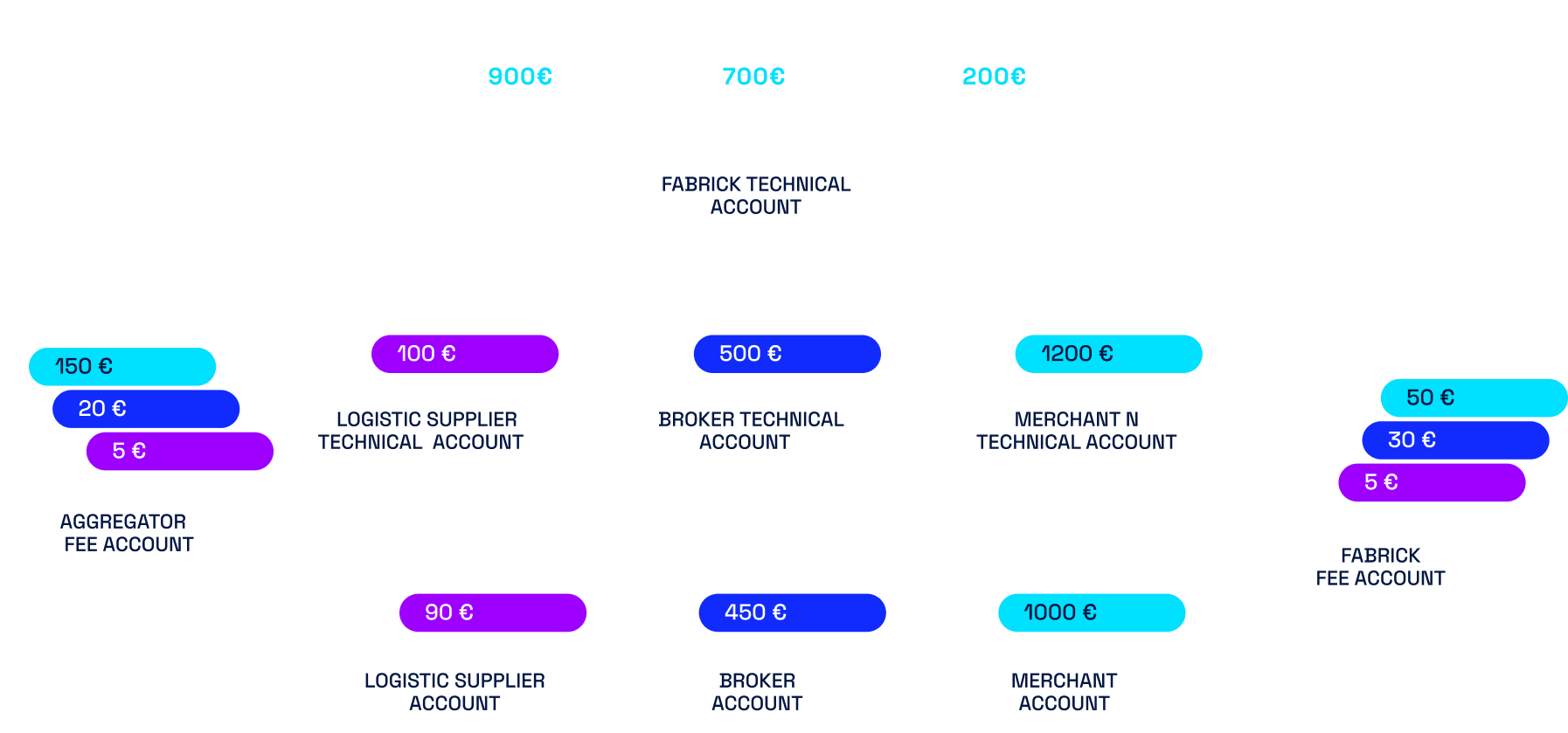

Fabrick Financial Split Payments collects incoming funds from gateways, acquirers, and alternative payment methods into a dedicated technical account.

PIt then splits the collections among all merchants, aggregators, and intermediaries involved in the transaction.

Finally, it settles direct and net of fees payouts to each party.

That’s how it works

Smart management for complex flows

Fees are automatically withheld, no manual steps needed.

Technical accounts are essential for collection splitting, but it’s Fabrick that takes care of setting them up.

Get access and track all payment data via a single Dashboard and build solid business strategies.

Custom rules for splitting collections

Fund distribution is defined by the merchant based on their specific business needs, offering full flexibility and control.

This means:

- Streamlined marketplace sells

- Embedded service sales made simple

- Simplifying P2P sells

Coming soon:

Dynamic splitting rules.

Custom rules for splitting collections

Fund distribution is defined by the merchant based on their specific business needs, offering full flexibility and control.

This means:

- Streamlined marketplace sells

- Embedded service sales made simple

- Simplifying P2P sells

Coming soon:

Dynamic splitting rules.

For businesses without borders

Fabrick Financial Split Payments is the perfect solution for payments chain management of companies operating on a global scale:

- Worldwide payouts

Coming soon:

- Customizable currency options

- Multi-curency payouts

- Fabrick PISP integration

- Go-live in France, Spain and the UK

For businesses without borders

Fabrick Financial Split Payments is the perfect solution for payments chain management of companies operating on a global scale:

- Worldwide payouts

Coming soon:

- Customizable currency options

- Multi-curency payouts

- Fabrick PISP integration

- Go-live in France, Spain and the UK

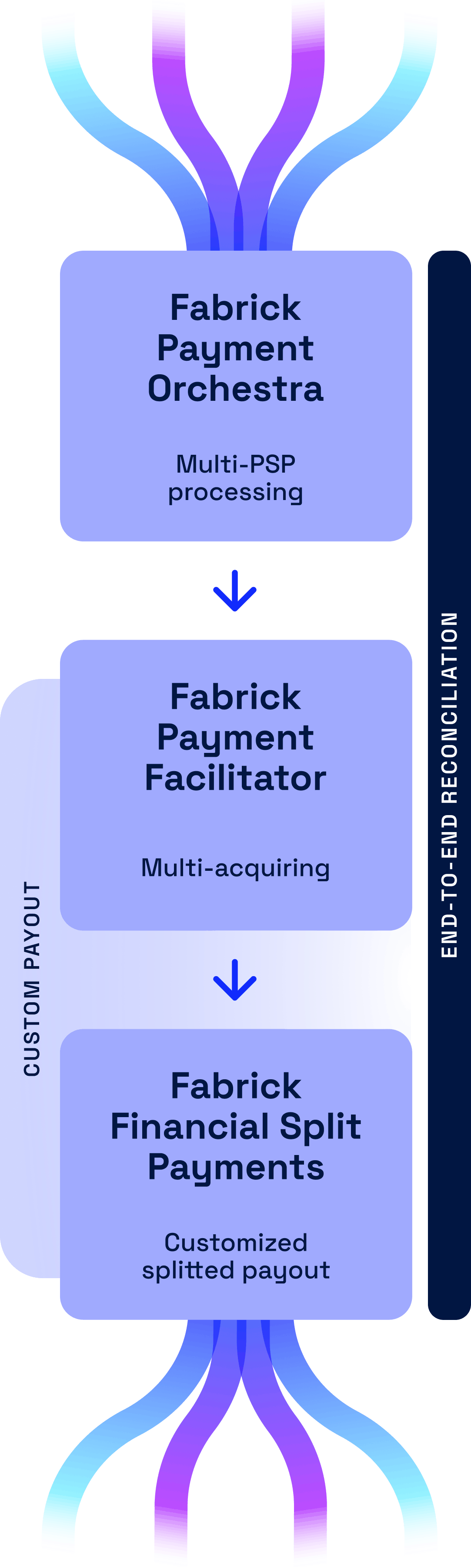

One platform to orchestrate the full payment chain

Stronger together: Fabrick’s integrated payment services create an end-to-end platform that manages every stage of the payment lifecycle.

Fabrick Payment Facilitator

- Multi-acquiring processing

- +15 credit currencies

- Integrated reporting

From theory to practice: use cases

Fabrick Financial Split Payments enhance agility and efficiency of managing incoming and outgoing payments in business models with multiple stakeholders:

- Seamless fee transfer to the aggregator

- Simplified management of mixed shopping carts

- Real-time fee allocation for intermediaries and brokers

- Automated collection split between the merchant and the service provider

- Secure, and compliant fund management

- Fast and simple distribution of collections between parties

Latest Insights

Integrating PISP services into the ERP system: invoice and payment reconciliation on a single platform

Why Open Finance and Embedded Finance are transforming the Energy & Utilities sector in the UK

Open Banking in 2026: Trends and What to Expect

Would you like more details about this product? Please fill out the form.

Contact our specialists to identify the most suitable solution for your needs.

Fabrick Financial Split Payments is not available in the UK. Fabrick provides this solution in Italy. If your business has a registered office in Italy and you would like information, please contact us here.