Fabrick Payment Gateway

The Ecommerce gateway for accepting payments worldwide on your website and in-app, thanks to over 250 alternative payment methods and 20 acquirers.

The payment platform to increase Ecommerce sales

Accept transactions from all over the world thanks to the most widely adopted alternative payments, leveraging the connection to international acquirers and availability of local currencies.

The technical documentation provides an effective and flexible gateway integration, resulting in a personalised user experience.

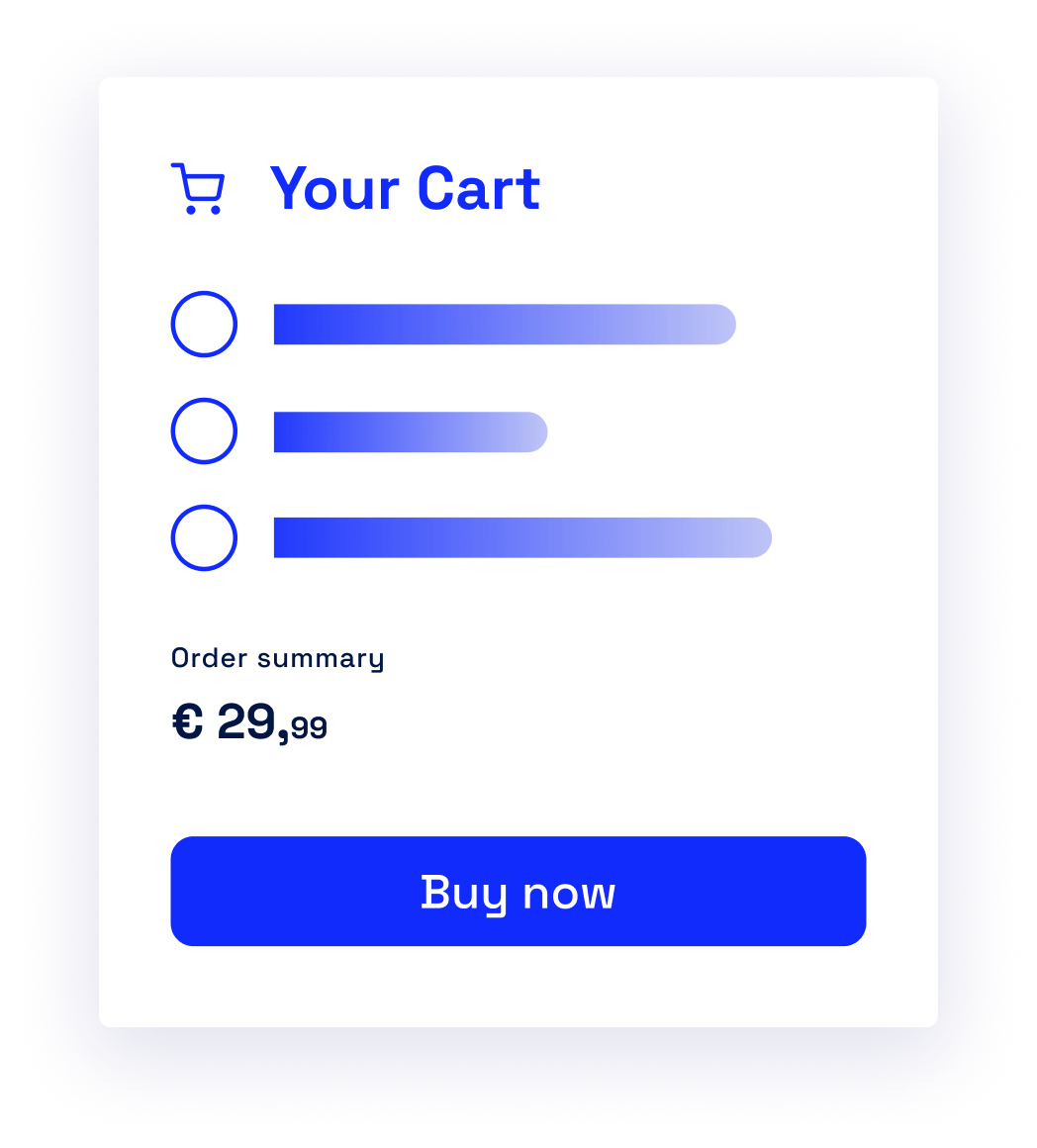

A check-out page that is optimised for all CMS platforms can be the asset to meet your customers' needs with a customised shopping experience.

Business management and reconciliation activities are streamlined, as all collection data is customisable and easy to export in a single Dashboard.

Gateway features and services

The Fabrick Payment Gateway is the result of over 20 years of collaboration with clients. Its functionality and user experience are constantly improved to help increase conversions and enhance customer loyalty.

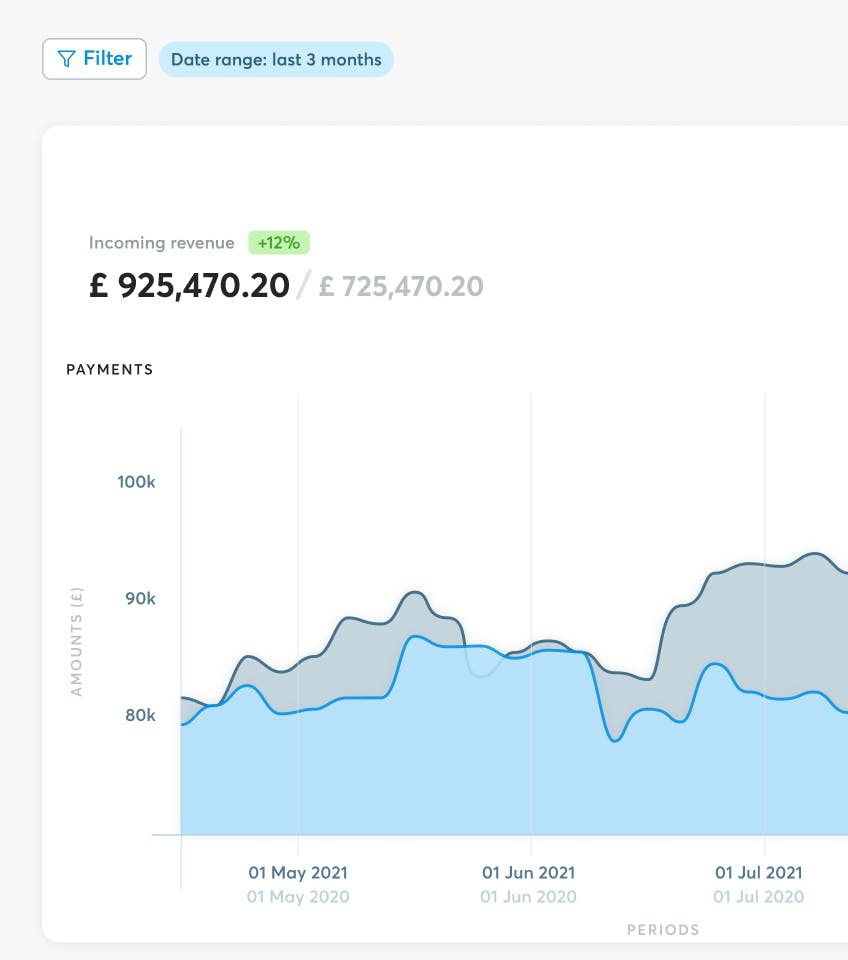

Simple and complete Dashboard

The Dashboard is the ideal tool to manage collections and have control over payments. Designed to meet even the most complex requirements, thanks to its payment management functionalities and automatic reporting, the platform allows to create teams with different levels of authorisation for internal use.

Simple and complete Dashboard

The Dashboard is the ideal tool to manage collections and have control over payments. Designed to meet even the most complex requirements, thanks to its payment management functionalities and automatic reporting, the platform allows to create teams with different levels of authorisation for internal use.

Customisable check-out page

Our Gateway offers a unique payment experience by adapting the check-out page to the website experience. The iFrame and Lightbox solutions provide the ideal integration for any Ecommerce.

Customisable check-out page

Our Gateway offers a unique payment experience by adapting the check-out page to the website experience. The iFrame and Lightbox solutions provide the ideal integration for any Ecommerce.

Network tokenization

The integration of network tokens from leading international networks minimises fraudulent transactions, enables 'one-click' payments and is essential for managing recurring payments, improving conversion rates.

Network tokenization

The integration of network tokens from leading international networks minimises fraudulent transactions, enables 'one-click' payments and is essential for managing recurring payments, improving conversion rates.

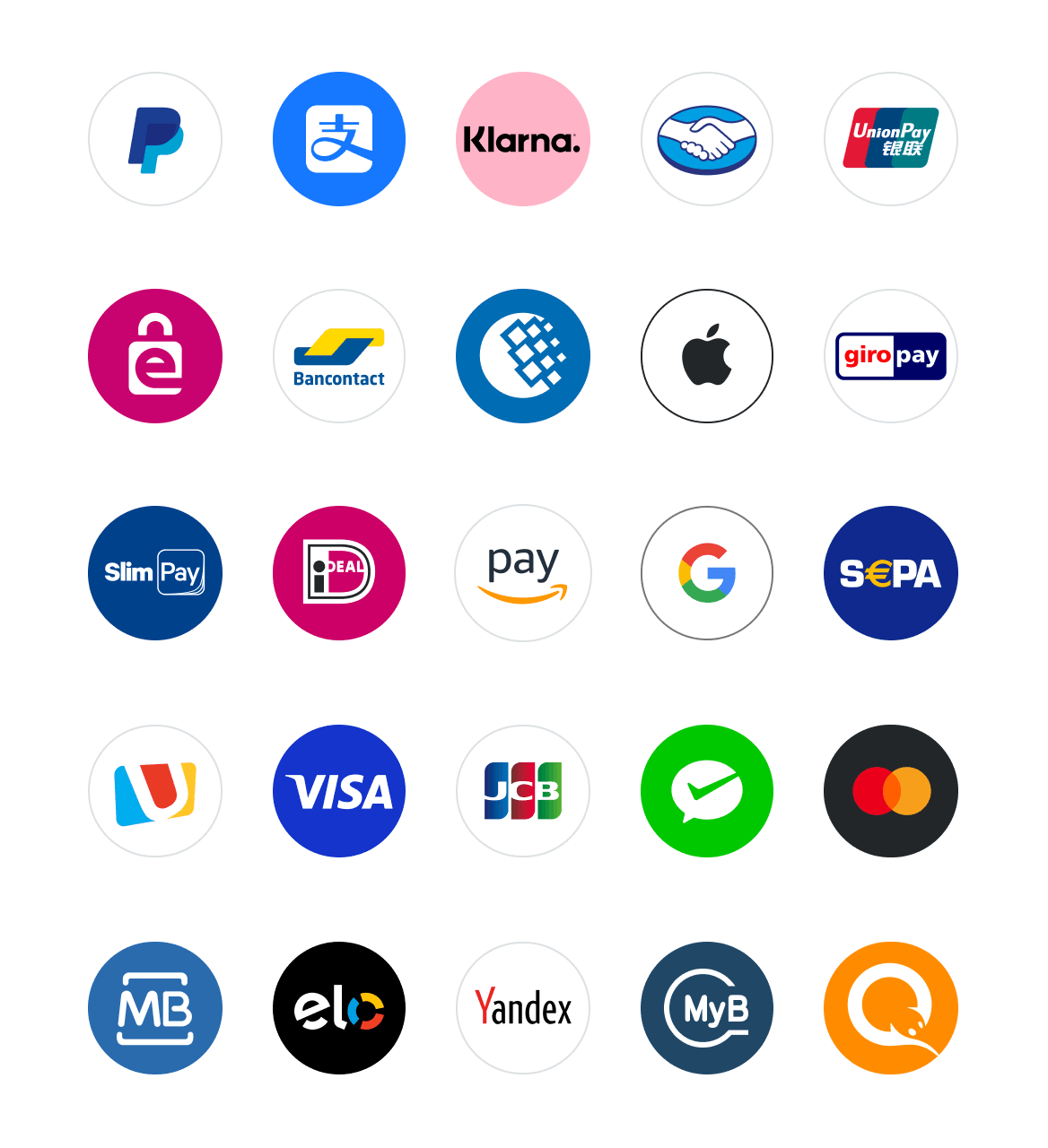

Alternative payments

A wide choice of alternative payment systems allows to accept local and international payments, in order not to miss a single sale and maximise collections while optimising customer journeys.

Alternative payments

A wide choice of alternative payment systems allows to accept local and international payments, in order not to miss a single sale and maximise collections while optimising customer journeys.

Ecommerce Automation

The authorisation call allows to set predefined rules to decide when a payment has to be authorised. This call can be useful when it comes to selling subscription products or services.

This function allows a payment to be refunded upon the occurrence of a specific event. For example, upon receipt of a returned product it is possible to refund the customer automatically, reducing manual processes.

With this call, collection and cancellation can be automated, depending on the Ecommerce logistics. For example, it is possible to set up an automatic collection whenever a product is shipped or a service is provided.

The history of each transaction can be retrieved through this call, which is ideal for generating customised and functional reports, reconciliation automation or for gathering payment information within management systems.

The Card Check call provides information on what type of card is attempting a payment. For example, it allows to check if the card number entered is correct in order to improve the customer's payment experience.

Latest insights

Embedded Lending revolutionizes financing for businesses and consumers

Ransomware: a growing trend in the cyberfraud landscape

Payment orchestration for optimised lending platforms: a complete guide

Would you like more details about this product? Please fill out the form.

Contact our specialists to identify the most suitable solution for your needs.