Fabrick Payment Orchestra

The payment orchestration platform to accept and manage cross-border end to end payments: thanks to an automatised, centralised, and integrated management of the entire payment lifecycle.

The benefits of payment orchestration

Increases efficiency by simplifying business activities, reducing errors and manual intervention.

Optimising payment handling processes reduces operating costs while improving efficiency and financial control.

Integration of fraud detection tools ensures secure payments and the protection of both end customers and the company.

Manage collection splitting between the parties involved, ensuring an efficient and balanced management of the pay-outs.

Being able to monitor all stages of the payment process ensures accurate control, traceability and regulatory compliance.

Automatically reconcile transactions with purchase orders, optimising efficiency and reducing errors.

Accept alternative cards and payment methods to meet the needs of individual markets and the purchasing habits of businesses and consumers, reducing both integration time and time to market.

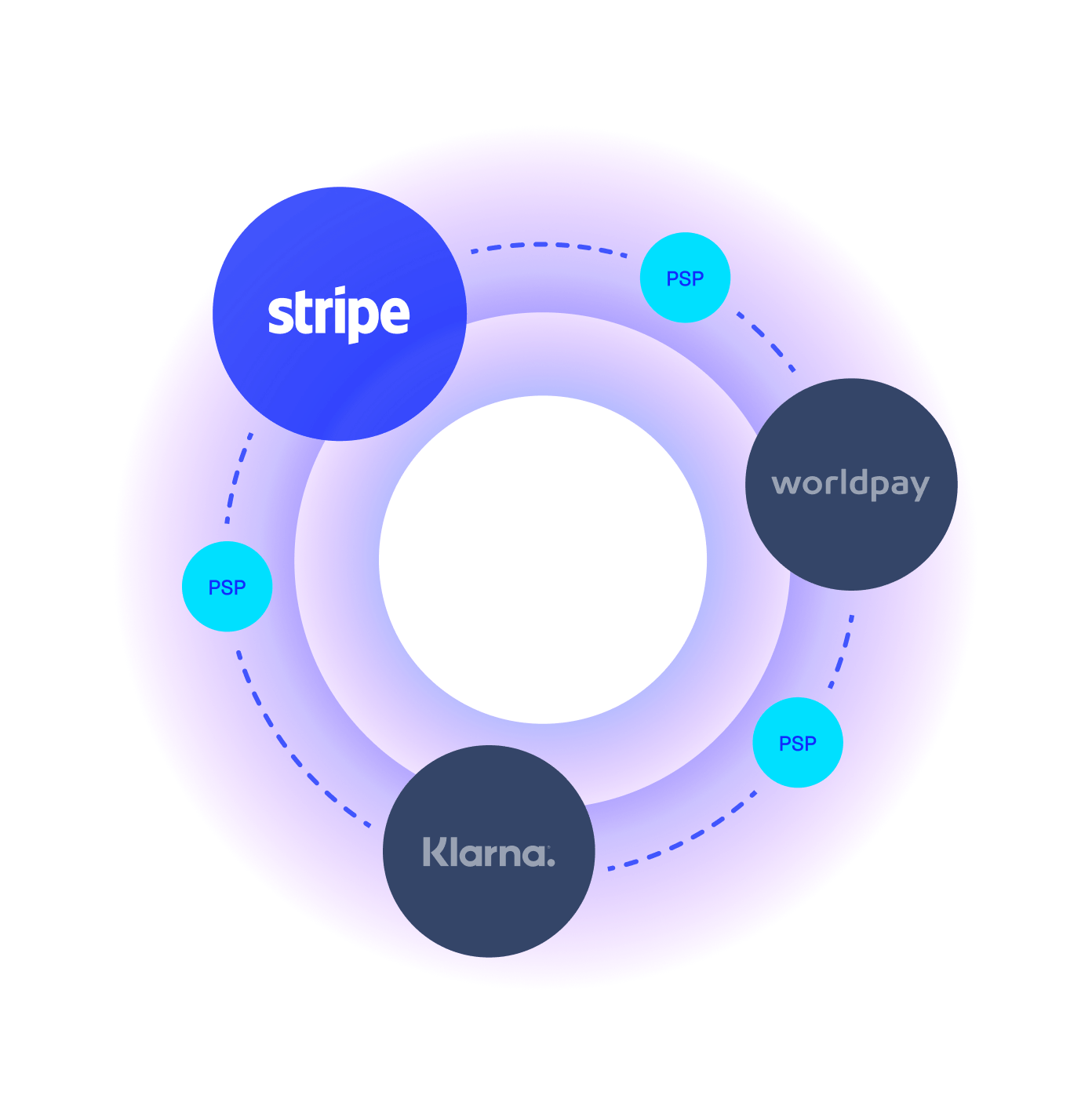

Single platform, multiple adapters

Orchestrating payments through a multi-provider solution maximises acceptance rates, as smart routing can direct payments executed via traditional and alternative methods to more efficient acquirers and fraud prevention systems for each transaction, optimising costs and the customer experience.

Single platform, multiple adapters

Orchestrating payments through a multi-provider solution maximises acceptance rates, as smart routing can direct payments executed via traditional and alternative methods to more efficient acquirers and fraud prevention systems for each transaction, optimising costs and the customer experience.

Payment management optimisation

Accept payments across all sales channels, physical and digital, thanks to a wide choice of payment solutions and centralised collection management on a single dashboard. Enable seamless online and offline touchpoints, ensuring frictionless customer journeys.

The platform facilitates payment collection and payment processes and reduces reconciliation time by automatically associating each transaction with the paid order, streamlining financial and cash flow management.

The commissions due to the agents and partners involved along the supply chain are automatically transferred to the stakeholders, both deferred and in real time, ensuring efficient management of financial flows and minimising manual error.

Streamline payment management by automatically distributing collections to merchants and sub-merchants, based on splitting rules set by the merchant, and facilitate reconciliation and reporting.

Value-added services of payment orchestration

The platform is designed to manage recurring payments (debited to an account or card) in an integrated way via a fully digital process, that starts from the mandate signature to the SDDs collection.

A virtual bank account number is associated with each buyer or invoice in order to automatically verify the issuing of individual bank transfer payments in real time.

Improve customer engagement by rewarding the most loyal customers with targeted coupons and referral programmes, seamlessly integrated into the payment cycle and customer journey.

Latest insights

Driving seamless mobility: payment orchestration in digital payments for automotive and smart mobility

Embedded Lending revolutionizes financing for businesses and consumers

Ransomware: a growing trend in the cyberfraud landscape

Would you like more details about this product? Please fill out the form.

Contact our specialists to identify the most suitable solution for your needs.