Insurance-as-a-Service: the open infrastructure for digital insurance models

The global insurance sector is undergoing a transformation driven by technological innovation and evolving consumer expectations. At the centre of this evolution are two fundamental trends: Embedded Insurance and Insurance-as-a-Service (IaaS), models that are reshaping how insurers design, distribute, and manage their products. These approaches rely on integrating insurance services into consumers’ everyday experiences, creating new value opportunities for all players in the financial ecosystem.

What is Insurance-as-a-Service (IaaS)?

It is an API-based model that delivers insurance functionalities—quotes, underwriting, policy issuance, claims management, payments—as composable services that can be integrated into apps and third-party channels. This architecture enables companies to adopt an Insurance as a Service API approach to embed insurance capabilities into digital touchpoints with minimal friction.

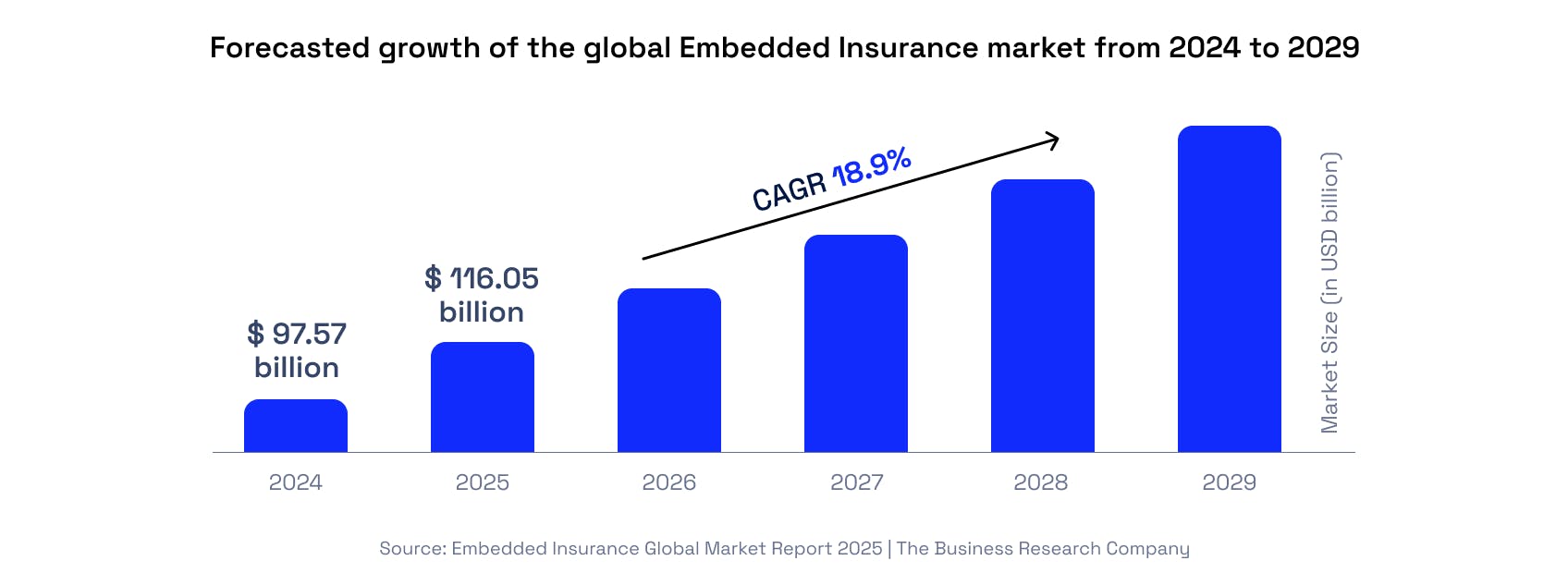

Recent market data reveals strong growth: the global Embedded Insurance market is set to expand from USD 116 billion in 2025 to over USD 232 billion by 2029, posting a compound annual growth rate of 19%.¹ This expansion is not driven solely by technological demand; it reflects a broader shift in consumer preferences, as users increasingly seek integrated and personalised digital insurance solutions over traditional policies sold through separate channels.

The Embedded Insurance paradigm: seamless integration into digital services

Embedded Insurance refers to the integration of insurance products directly into the purchase flow of other goods and services, eliminating the need for separate transactions and creating a smooth customer experience. This model differs from traditional insurance due to its ability to offer contextual and relevant coverage at the exact moment the customer needs it, turning insurance from a standalone product into an integrated digital service.

Global market segments and sector penetration

The automotive sector, which accounts for 28.4% of the global market, and life insurance, with a 22.6% market share, represent more than half of the total market. Other segments are also experiencing significant growth: the pet insurance sector is projected to grow at a 39% CAGR from 2024 to 2029², driven by rising pet ownership and more advanced integration of these services into veterinary platforms and Ecommerce ecosystems. Health insurance is also expanding rapidly, with a 28% CAGR, supported by integration with wearable devices and digital health platforms.

Technological and market drivers

The rise of Embedded Insurance is supported by several converging factors. The widespread adoption of digital platforms and Ecommerce has created the infrastructure needed for frictionless integration of insurance services. Modern APIs allow real-time integration across platforms, while artificial intelligence and data analytics enable personalised coverage tailored to behavioural patterns and individual risk profiles.

Today, around 87% of Embedded Insurance products worldwide rely on API integrations to deliver real-time insurance services.

Source: Embedded Insurance Industry Statistics 2025: Regional Insights, Technology Trends, and Market Growth | CoinLaw, August 2025

Consumer preference shifts represent another key driver: approximately 70% of consumers prefer Embedded Insurance when it is integrated into digital platforms they use regularly. This preference results in significantly higher conversion rates, with partners reporting performance 40% higher than traditional referral models³.

Insurance-as-a-Service: the modular architecture of the future

Insurance-as-a-Service is an even more transformative model because it provides modular components of the entire insurance value chain through cloud-native platforms. This model enables non-insurance companies, including emerging Insurance-as-a-Service startups, to offer insurance products without building complex proprietary infrastructure, while helping traditional insurers modernise operations quickly.

IaaS: benefits for insurance companies

For insurers, adopting IaaS models offers substantial advantages in terms of operational agility and access to new distribution channels:

- shorter product launch cycles, reduced from months to weeks, representing a critical competitive advantage

- inherent scalability of cloud platforms, enabling rapid geographical expansion

- ability to offer product lines through flexible and modular configurations

- access to new distribution channels through partnerships with non-insurance companies that already maintain strong customer relationships

This approach reduces customer acquisition costs and increases contextual relevance, supporting insurers in a market no longer defined exclusively by direct competitors.

Opportunities created by Insurtech for end consumers

From a consumer standpoint, both IaaS and Embedded Insurance offer benefits that extend beyond convenience. Transparent coverage supported by intuitive digital interfaces allows customers to better understand what they are purchasing. Continuous 24/7 access eliminates traditional time constraints, while chatbots and AI assistants provide immediate support for basic queries.

Personalisation is one of the most significant benefits: through advanced data analytics and machine learning, insurers can offer tailored coverage that accurately reflects individual risk profiles. This increases relevance and often results in more competitive premiums for low-risk customers.

Insurtech market data: +26% by 2032

Market statistics confirm the impact of these trends. The global Insurtech market, which includes Embedded Insurance and Insurance-as-a-Service solutions, was valued at USD 15.56 billion in 2024 and is expected to reach USD 96.10 billion by 2032, with a 26% CAGR⁴. Growth is supported by rising investment in digital technologies: over 80% of insurance companies plan to increase investment in AI technologies in the coming years⁵.

API integration is becoming the de facto industry standard, with over 74% of embedded premiums now flowing through online API channels³. This shift toward digital infrastructure is generating measurable operational improvements: insurers adopting API-driven solutions report 40% shorter claims-processing cycles and a 76% increase in straight-through processing rates⁶.

Fabrick’s role as a technological enabler of insurance digitalisation

In this environment of digital transformation, Fabrick positions itself as a key enabler for the evolution of the insurance sector through its Open Finance platform.

Fabrick’s technological architecture follows an open and modular platform model that simplifies the integration of digital insurance services across industry segments.

Fabrick’s technological offering for insurers

At the core of Fabrick’s offering for the insurance sector is the Payment Orchestration Platform, designed to optimise the entire insurance premium payment lifecycle. The platform integrates a wide set of traditional and innovative payment methods, including:

- recurring direct debits (SDD) and cards

- Virtual POS and physical POS

- PSD2-compliant Pay by Bank payments

This multi-channel orchestration enables insurers to offer a seamless and personalised payment experience, removing technological barriers that have historically slowed the adoption of new payment methods in the sector.

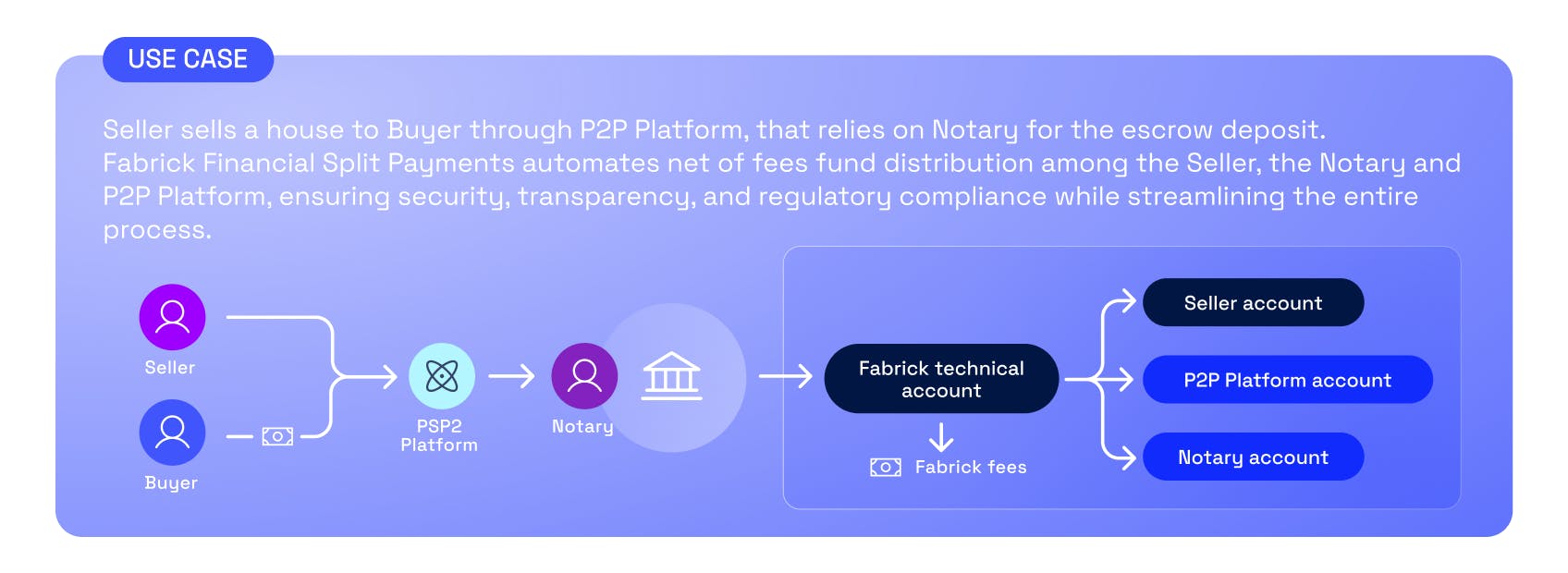

Split Payments: the solution for automated flow management

This functionality fully automates the distribution of incoming payments among all stakeholders in the insurance distribution chain:

- centralised collection of all incoming flows into a dedicated technical account

- automatic splitting of funds among insurance companies, agencies, intermediaries, and other parties based on predefined rules

- automatic payouts net of commissions for each stakeholder

This approach eliminates the need for manual double-entry bookkeeping, significantly reducing administrative time and minimising errors.

Fabrick’s Financial Split Payments automates and simplifies payment flow management by collecting all incoming funds from gateways, acquirers, and alternative payment methods into a dedicated technical account managed by Fabrick. Funds are then automatically allocated to companies, agents, and other stakeholders according to rules defined by the merchant.

Automated reconciliation and operational transparency

Fabrick’s platform provides advanced reconciliation tools that allow insurers to monitor all payment flows in real time through a unified dashboard. This capability is essential for managing complex distribution networks that require precise and timely financial oversight.

The system also includes advanced due-date monitoring and automated reminders that help reduce the risk of missed instalments.

The strategic partnership with Reale Group

The partnership with Reale Group is one of the most significant case studies of Fabrick’s role in the insurance sector. The collaboration evolved from an operational partnership into a strategic investment by Reale Group in Fabrick’s share capital, highlighting the value of Open Finance platforms for insurers.

“Reale Group has recognized the innovation offered by Fabrick’s platforms as an opportunity to evolve its operating model for the management of premium collections, allowing our networks to offer different means of payment, both traditional and innovative.”

Massimo Luviè

Joint General Manager of Reale Mutua Assicurazioni and General Manager of Banca Reale

The integration of Fabrick’s payment orchestration platform into the Reale Group ecosystem has digitalised and optimised the management of insurance payments, making the experience more intuitive for customers and agencies. The system’s flexibility simplified administrative processes and accelerated innovation, enabling the development of instalment-based products such as “Insurance Credit”.

Fabrick acts as a strategic enabler, supporting the digital evolution of insurers through open infrastructures, secure APIs, and the connection of multiple industry stakeholders, enabling the transition toward Embedded Insurance and Insurance-as-a-Service models.

Conclusions

In conclusion, Insurance-as-a-Service and Embedded Insurance are not merely technological trends, but the natural evolution of an insurance sector adapting to the needs of an increasingly digital and interconnected world. Insurers that embrace this transformation, supported by innovative platforms like Fabrick’s, will be best positioned to compete in the future insurance ecosystem.

Sources

Embedded Insurance Global Market Report 2025 | The Business Research Company

The Future of Embedded Insurance & How to Improve It | binariks, 2025

Embedded Insurance Industry Statistics 2025 | CoinLaw, 2025

Insurtech Market Size, Share & Industry Analysis | Fortune Business Insights, 2025

Insurance statistics | zipdo, 2024

The Role of API integration in modern insurance platforms | 2025

Our insights

Agentic Payments: when the “buyer” becomes an AI agent

Integrating PISP services into the ERP system: invoice and payment reconciliation on a single platform